Latest posts

-

Personal Tax return

In Bangladesh, filing a personal income tax return is mandatory for individuals whose annual income exceeds specific thresholds, as…

-

Tax Planning

Tax planning for companies in Bangladesh involves strategically managing financial and tax obligations to minimize liabilities while ensuring compliance…

-

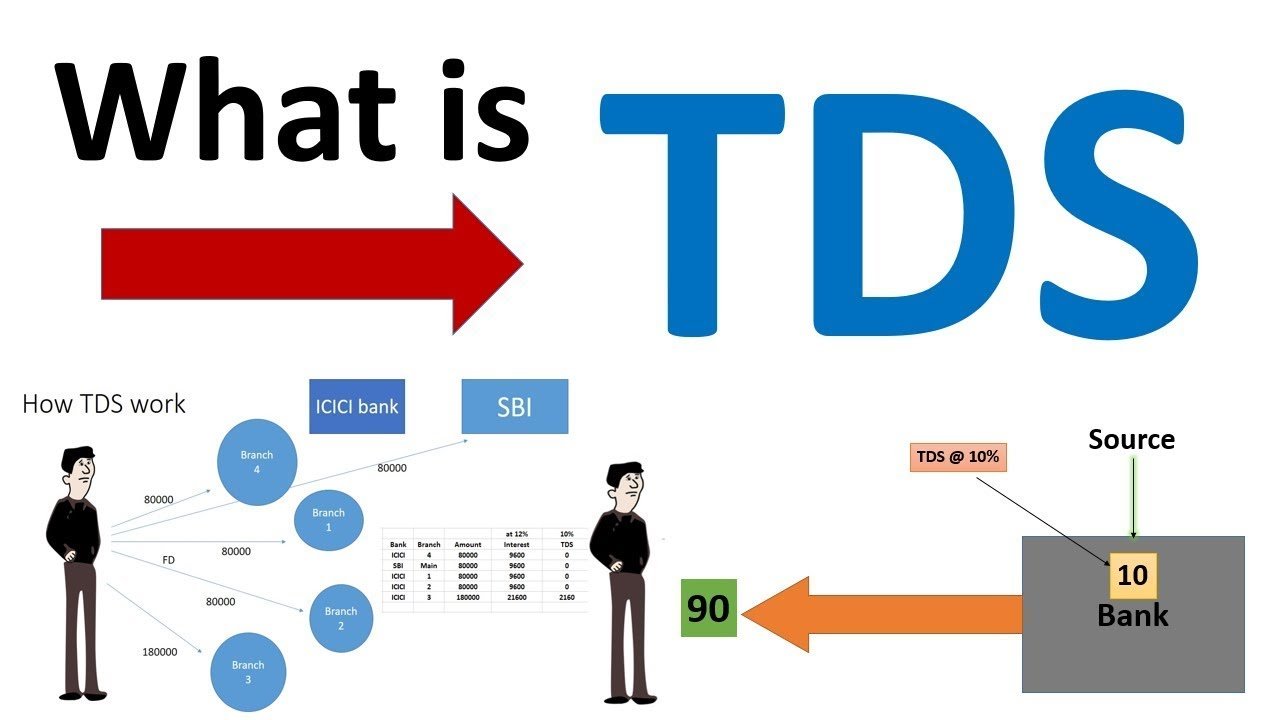

What is TDS

Tax Deducted at Source (TDS) is a taxation mechanism where a specified percentage of tax is deducted by the…

-

What is VDS

In Bangladesh, VAT Deduction at Source (VDS) is a mechanism where certain designated entities are required to deduct Value…

-

What is withholding Tax

Withholding tax (WHT) refers to the income tax that a payer (either resident or non-resident) is obligated to deduct…

-

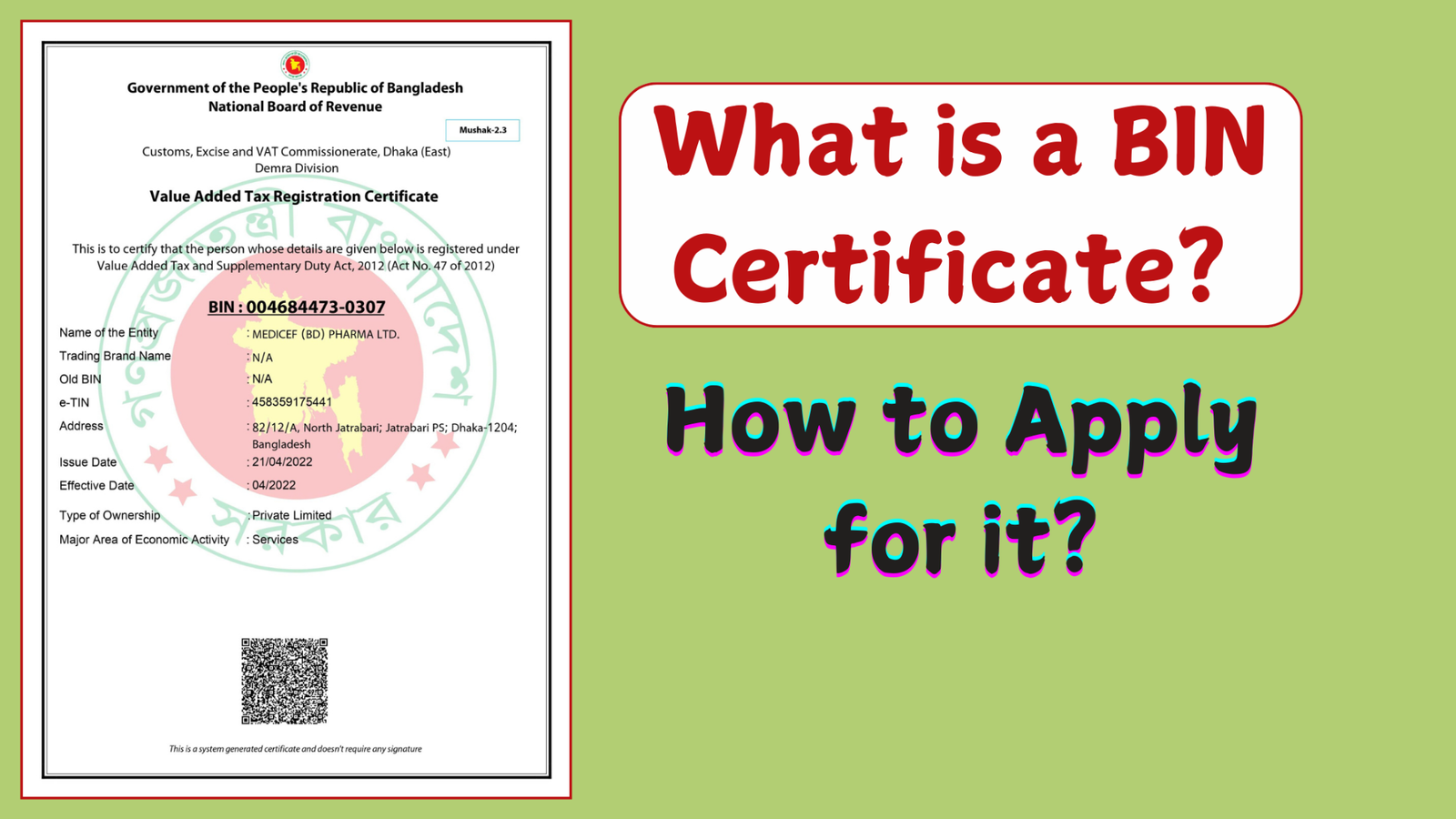

How to open BIN Number

To open a Business Identification Number (BIN) in Bangladesh, you must register with the National Board of Revenue (NBR).…

-

How to Get a TIN Certificate in Bangladesh (e-TIN Registration Process Guide)

Introduction As per the Income Tax Act 2023 of Bangladesh, it is mandatory for all eligible taxpayers—including individuals and companies registered…

-

Corporate tax rate

The corporate tax landscape in Bangladesh as of 2025: 📊 Corporate Income Tax Rates Publicly Traded Companies: Subject to…

-

Bonded Warehouse

Bonded warehouses are facilities authorized by the National Board of Revenue (NBR) that allow export-oriented industries to import raw…

-

Environment Clearance

In Bangladesh, obtaining an Environmental Clearance Certificate (ECC) is mandatory for establishing and operating industrial units and projects, as…