Categories of Bonded Warehouses:

Categories of Bonded Warehouses:

-

Special Bonded Warehouses (SBW): These are designated for 100% export-oriented ready-made garment (RMG) industries, including woven garments, knitwear, and sweater manufacturing.

-

General Bonded Warehouses (GBW): These apply to other 100% export-oriented industries, such as shipbuilding, accessories manufacturing (e.g., packing materials, labels, buttons), and certain home consumption industries (e.g., sugar, vegetable oil, leather, tobacco).

Benefits of Bonded Warehousing:

-

Duty-Free Imports: Industries can import necessary materials without paying customs duties upfront, improving cash flow and reducing production costs.

-

Deferred Duty Payment: Duties are paid only when goods are cleared from the warehouse for domestic sale, allowing businesses to manage working capital more effectively.

-

Storage Flexibility: Imported goods can be stored for extended periods (up to two years for export-oriented industries), providing flexibility in inventory management and production planning.

-

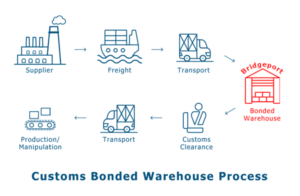

Facilitated Export Processes: Bonded warehouses streamline the export process by allowing direct export of goods without the need for customs clearance at the port, saving time and reducing logistical complexities.

To utilize bonded warehousing facilities, businesses must obtain a bond license from the Customs Bond Commissioner ate. The application process includes submitting various documents, such as business registration, tax identification number, trade license, and financial statements, among others.

To utilize bonded warehousing facilities, businesses must obtain a bond license from the Customs Bond Commissioner ate. The application process includes submitting various documents, such as business registration, tax identification number, trade license, and financial statements, among others.

It’s important to note that while bonded warehouses offer significant advantages for export-oriented industries, regulations and procedures are subject to change. Therefore, businesses should regularly consult official sources or seek professional advice to ensure compliance with current laws and regulations.